They say it takes a village to run a business, but this village is supported by business applications. Any given business, based on their industry or business model, will use multiple business applications to manage operations. While it’s important to avoid relying on too much software, it’s essential that key business applications connect to your accounting system.

Why Business Applications Need to Connect to Your Accounting System

There are tons of business applications available that perform specific functions related to the type of work you’re doing. The rule of thumb for connecting an application to your accounting system is when money is involved. If an application generates a transaction or documents a process that will create transactions resulting in debits and credits, this needs to be accounted for in your accounting system. Otherwise, your financial management will take a lot more effort to just to maintain accuracy.

Without consolidating all the financial data from your business applications into a single system, you’ll end up managing this information on multiple spreadsheets or applications. Besides requiring more work to maintain these finances, you risk creating financial data inconsistencies and mistakes through simple human error. Connecting your business apps to one robust accounting software frees up your time and ensures your company’s finances are seamlessly managed in one location – no more hassle.

Business Applications that Need to Connect to Your Accounting System

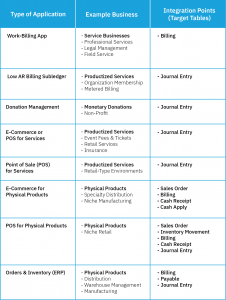

Remember, accounting begins when transactions generate debits and credits. When this happens, your application needs to work with your accounting system to begin the financial lifecycle. Here are a few business application types that will need to connect to your accounting system:

Work-billing

Work-billing applications track billable services performed for customers, creating an invoice for the customer. The billing integration point is where this data is transferred into the accounting system for crucial functions like revenue recognition, general ledger accounting, and financial reporting.

Low AR Billing Subledger

Low AR Billing Subledger apps are for organizations who don’t need to manage accounts receivable or collections as a part of their business cycle. For example, streaming companies like Netflix don’t record assets as a part of the billing cycle. Instead, they rely on a binary payment system that simply accepts payment for the service as revenue – or there is no further service provided. This payment data is captured in the specialized billing and payments application and traditionally integrated into the accounting system as a journal entry.

Donation Management

Donation management apps let non-profit teams track, analyze, and manage supporter relationships. These applications also document money donations received which connect into the accounting system typically via a summary journal entry.

E-Commerce for Services

E-commerce applications for the sale of services are used to record the sale of services or subscriptions for online businesses. Usually, these apps connect to the accounting system via journal entry.

Point of Sale (POS) for Services

Point of Sale applications for the sale of services are used in retailenvironments (like a hair salon or a dance studio) to record the sale of retail services. Typically, these apps connect to the accounting system via journal entry.

E-commerce for Physical Products

Some E-commerce apps are specialized in selling tangible products online. For example, a niche manufacturer may use an e-commerce software to process orders for online customers who want an item shipped to them. E-commerce apps dealing with physical products often connect into the accounting system through sales order, billing, cash receipt, and cash apply integration points.

Point of Sale (POS) for Physical Products

This application is used by retail businesses to process orders and payments for physical products being sold in person. The POS application initiates the exchange between customer and buyer, but the accounting system manages the rest of the financial management processes like expenses and balancing the general ledger. After capturing the product exchange, the POS transfers data to the sales order, sales order inventory movement, billing, cash receipt, and cash apply integration points.

Manufacturing and Distribution (Orders and Inventory) aka ERP

Some accounting software, like Accounting Seed, include order management and inventory features out-of-the-box. However, stand-alone orders and inventory applications need to be paired with a dedicated accounting system for high-level financial management. These apps usually connect into the accounting system through billing, payable, and journal entry target tables.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.