Guide to AP Automation

Spend 80% less time paying bills

In this three-part guide, you'll learn how automating your Accounts Payable can simplify payments, improve spend management, and drive faster growth.

Guide to AP Automation

In this three-part guide, you'll learn how automating your Accounts Payable can simplify payments, improve spend management, and drive faster growth.

Learn how to reduce manual work and manage payments 80% faster with automation, turning your AP function into a competitive advantage.

Read Part 1Discover the key features of AP automation, from automated payments to enhanced security and real-time financial insights through seamless integration.

Read Part 2Assess your current processes and discover the steps you need to take to prepare for implementing AP automation to enhance efficiency and decision-making.

Read Part 3Part 1

Turn AP from a cost center into your competitive advantage with automation

Running a business means there's always a bill to pay, whether it's to rent your office, ensure suppliers deliver what you need, or stay in good standing with vendors who play a key role in supporting you. Managing payments effectively is critical to staying within budget and protecting your cash flow, so you know what needs to be paid now and how to plan for the future.

Every month, without pause, Accounts Payable (AP) faces a continuous flow of financial obligations. The finance team is under pressure to make recommendations on who to pay, track approval workflows, process payments on time, and make sure everything gets reconciled so leadership has the financial insights they need to drive the business forward.

In fact, 60% of AP professionals still manually key invoices into their ERP/accounting software, while 72% spend up to 10 people-hours per week (or 520 hours per year) on AP related tasks that could be automated. This inefficiency is particularly concerning given that, on average, firms anticipate a 50% increase in payments and 46% increase in invoices delivered over the next three years.

The delays don't just frustrate the finance team—they ripple up to the C-Suite, where strategic decisions are put on hold when crucial financial reports are either delivered late or unreliable. This impact on decision-making is significant, considering 73% of executives at mid-size firms report that AP automation improves cash flow, increases savings, or contributes to business growth. The lag in AP automation adoption presents both a challenge and an opportunity for businesses looking to gain a competitive edge.

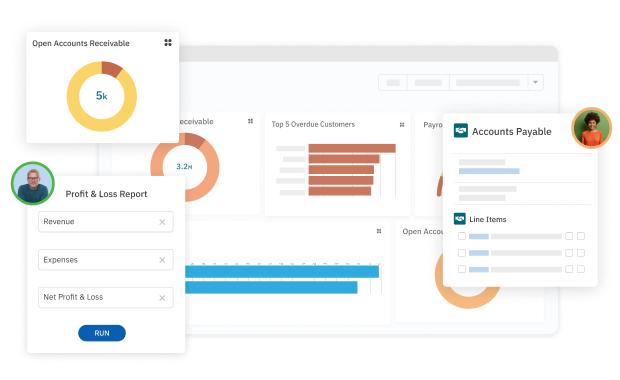

From the time you receive a bill to the time it's reconciled, solutions like AP Automation from Accounting Seed have automated the entire process and made it possible to do everything within a single platform. Not only that, but because Accounting Seed is built directly on Salesforce, organizations can manage it all from their CRM. As a result, financial data from sales transactions automatically flows into the accounting system, reducing errors and providing real-time visibility into the company's financial position.

All told, AP automation can save organizations between 70%-80% of the time usually spent on AP activities so the finance team can add more value to the business, reduce costs, and flag opportunities. In industries with high AP processing needs—like manufacturing, energy, construction, and hospitality—the pressure on the AP function can be immense, and the upside of automating even bigger. Even among companies with lower AP processing needs, the benefits can be striking and immediate.

Automation can save organizations 80% of the time usually spent on AP activities so the finance team can add more value to the business, reduce costs, and flag opportunities.

However, more than one-third of businesses have not automated any part of their AP processes, citing apprehensions about cost and complexity as obstacles. Meanwhile, paper checks have historically been tied to as much as half of all B2B payment transactions. C-suite leaders worry about how a new system might impact cash flow in the short-term, the disruption of daily operations, and whether now is the right time to invest. Meanwhile, those managing AP fear losing control or visibility over the process and are uncertain about how the technology will improve their jobs.

But putting off automation of this key function can be problematic—and ultimately harmful to the business. Here, we’ll highlight the key benefits of AP automation, not just for the finance team but throughout the highest levels of your company, and why overcoming these concerns is essential for your company’s growth.

A company’s leadership team is usually under pressure to meet aggressive growth targets, which requires visibility into cash flow in real-time—not weeks or months after the fact. Additionally, CFO’s and finance teams are constantly seeking ways to reduce operational complexity, enhance security, and improve the accuracy of their financial analytics. AP automation can add significant value by offering:

Do you really know how much money your business spends in any given month—and where that leaves your cash balance? A survey revealed that 49% of executives worry about the reliability of their cash flow information and 98% believe they could have better cash flow visibility. Automated processes eliminate the errors and delays common with manual entry so your AP team can deliver reliable real-time financial insights and analytics to an organization faster. With this level of insight, it becomes a lot easier to make informed decisions and focus on growth opportunities without delay.

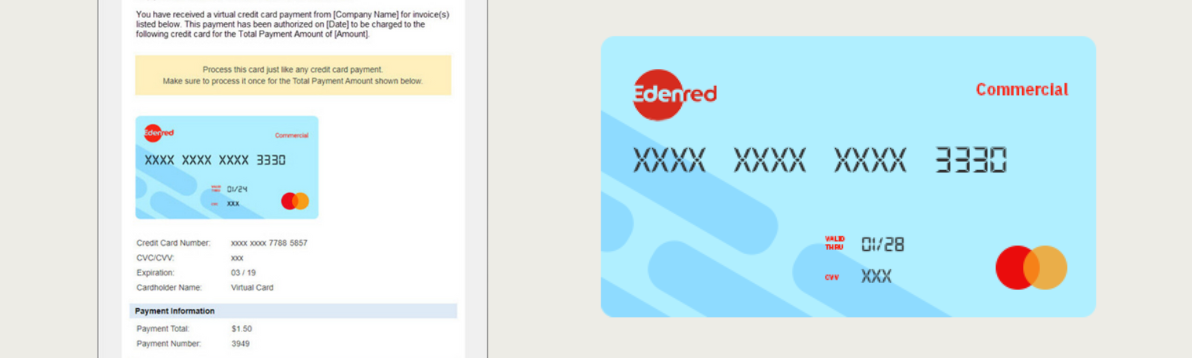

An organization’s AP function can be vulnerable to fraud; in fact, 44% of global finance teams reported knowing someone who had been a victim of AP fraud in the last three years. AP automation can significantly reduce the risk of fraud by securing storing all information in one system—making it easier to verify vendor authenticity and ensure payment legitimacy. In addition, virtual cards provide a unique, single-use payment option, and without a physical card to access they are one of the most secure payment methods available.

AP automation also leads to significant cost savings by reducing the need for additional staff to manage increasing transaction volumes. At a time when 76% of CFOs say they are facing a significant talent shortage, automation becomes an even more attractive solution. Additionally, if you pay your vendors by virtual card, your organization can skip the fees associated with checks and ACH and may have the opportunity to earn rebates. So you can consider that as either lowering your cost or opening up another revenue stream, all while gaining real-time cash flow visibility.

Those responsible for AP are typically detail-oriented by nature. So when the topic of automation comes up, they may have concerns around whether it will mean a loss of oversight of the payment process. But in reality, the right tools can actually help finance teams save time and get better visibility over the entire AP workflow, from the moment an invoice comes in to the time a payment is reconciled. Instead of manually tracking every step, automation allows teams to maintain oversight and ensure that everything is done correctly without staff having to touch every single task.

Here are a few key benefits to expect from AP automation:

One of the most immediate benefits of AP automation is the significant reduction in manual data entry and repetitive tasks. Respondents in our recent webcast reported manual AP tasks consume at least 25% of their teams’ time. AP automation can help you reclaim those lost hours by creating efficiencies from the time you receive a bill to when it's cleared in your bank reconciliation. For instance, rather than a team manually entering bills into the system, AP automation allows your vendors to send bills to a designated email address, where they're automatically picked up and turned into payables. Instead of your staff sorting through and prioritizing bills for approval, the system can quickly find and group bills, calculate early-pay discounts, and create batches for approval.

Finally, after payments are approved, automated payment distribution can handle the disbursement, applying cash and credit memos to payables and sending payments via the vendor's preferred method—whether virtual card, ACH, or check. As the last step, when bank transactions are downloaded, payments are automatically matched/added and cleared in the bank reconciliation, eliminating the need for manual intervention.

According to BlackLine, 37% of CFOs admit they don’t fully trust their own financial data—a sentiment shared by 50% of senior finance and accounting professionals, despite being closer to the numbers. This lack of confidence often stems from the potential for human error in manual processes. If a vendor name is mistyped or invoice amount inputted incorrectly, it can lead to payments being sent to the wrong supplier or cause discrepancies that need to be corrected later.

AP automation allows organizations to work more efficiently and confidently. With automated processes, invoices are automatically matched to the correct vendor record, minimizing mismatched payments and incorrect entries. This accuracy ensures:

Reduced likelihood of paying the wrong vendor or incorrect amounts.

Consistent and reliable financial data across all systems.

Accurate record-keeping for audits and regulatory requirements.

Reduced need for retrospective adjustments and reconciliations.

As a result, not only does leadership get the financial reports they need faster, but they can also trust the numbers, which is something everyone can appreciate.

By automating routine tasks, teams will be able to handle higher volumes of work more efficiently, allowing more strategic focus within an organization. With manual methods, finance teams can typically process around five invoices per hour. Through the power of AP automation, this number jumps to 30 invoices per hour.

This increased efficiency empowers a finance professionals to:

Instead of spending hours on data entry, finance teams can dedicate time to financial analysis and strategic planning.

With up-to-date data, finance professionals can offer timely insights to guide business decisions.

By shifting to more analytical roles, finance team members can develop new skills and contribute more to the organization.

Better financial data facilitates improved communication with other departments, allowing finance professionals to play a more integral role in business operations.

Instead of spending hours on data entry, finance teams can dedicate time to financial analysis and strategic planning.

With up-to-date data, finance professionals can offer timely insights to guide business decisions.

By shifting to more analytical roles, finance team members can develop new skills and contribute more to the organization.

Better financial data facilitates improved communication with other departments, allowing finance professionals to play a more integral role in business operations.

With the efficiencies gained, suddenly finance teams have time to help with budgeting, forecasting, and financial analysis, increasing their value to the business.

AP automation also enhances supplier relationships by ensuring payments are processed quickly and accurately. This can be realized through the security and dependability of using digital payments. In addition, when a business provides a higher level of service, it strengthens their partnerships, leading to better terms and more collaborative opportunities.

Part 2

You’re eager to see how automating your AP will save your organization time and reduce errors. However, not all AP automation solutions are the same. For instance, some solutions require complex integrations to work or will need more manual oversight than others. When making a selection, you want to think about the needs of your finance team, what’s going to add the most value to your business and whether the solution will scale as you grow. Otherwise, you’ll have to restart the process once you reach a certain size. As you seek out an AP automation solution, here are a few key features you should look for and why they add value:

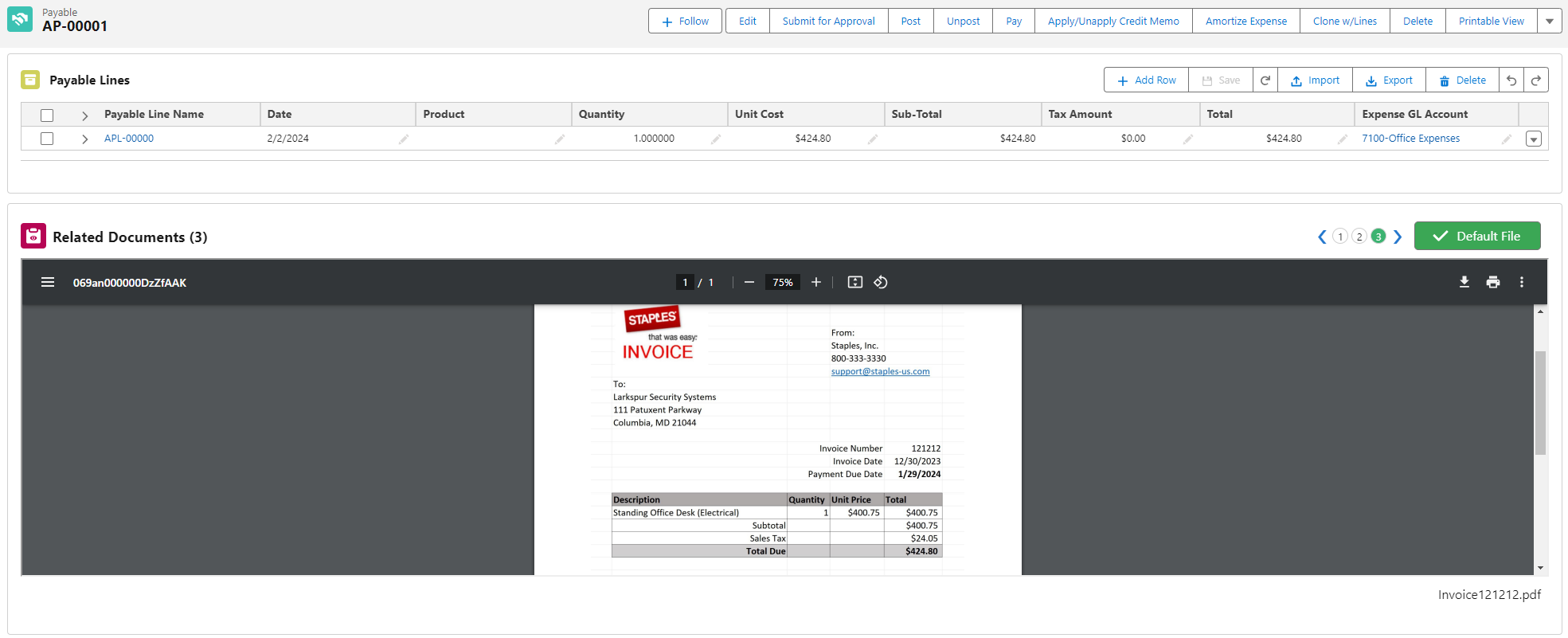

An automated AP solution streamlines the entry of bills into your system with automated email processing. Vendors send their invoices to a designated email address, where they are automatically picked up and a payable is created. The system intelligently matches the vendor based on the sender’s information, minimizing manual input. An image of the bill is displayed on-screen, allowing you to quickly review and complete any additional fields before saving and posting the payable. This feature reduces errors, speeds up data entry, and ensures all invoices are accounted for in real-time.

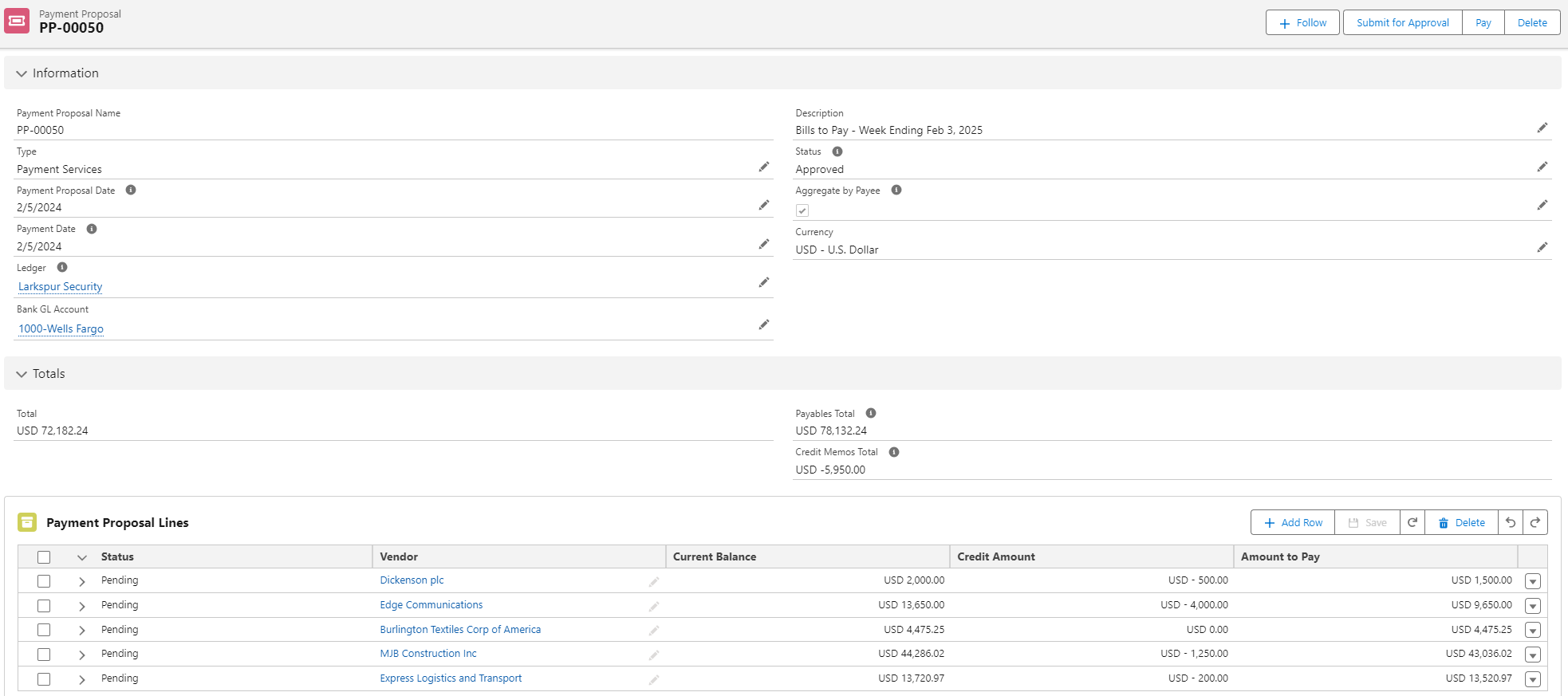

Payment proposals simplify the time-consuming process of identifying and grouping bills for payment. Whether you’re paying a single vendor or managing complex searches—like grouping all bills from a specific project or those offering early-payment discounts—this feature makes it easy. Ideally the system you choose can automatically calculate discounts based on your payment schedule, ensuring you never miss out on savings.

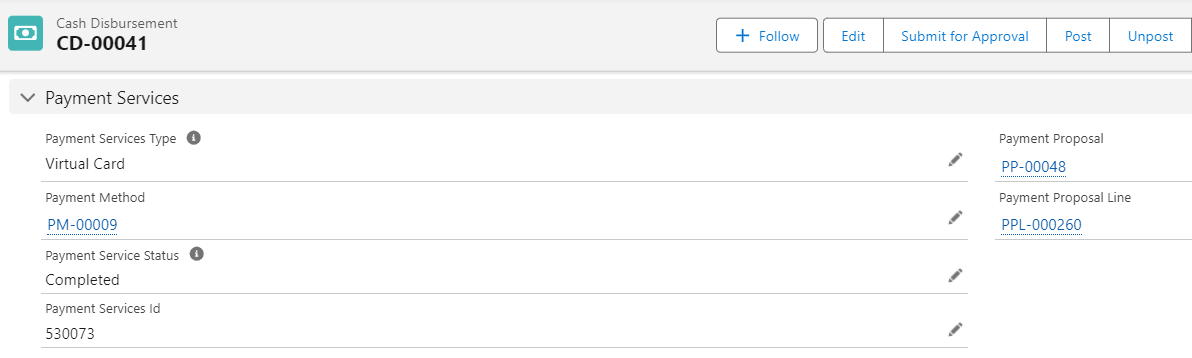

Once payment proposals are approved, automated payment distribution ensures the timely disbursement of funds. Scheduled jobs automatically handle the payment of approved batches, creating cash disbursement records, applying credit memos, and distributing payments via the vendor’s preferred method—whether that’s a virtual card, ACH, or check. This feature not only saves time but also reduces the risk of errors and fraud, while providing vendors with timely payments and detailed remittance advice.

Increase security and reduce transaction costs with virtual cards—single-use credit card numbers generated for specific vendor payments. By using virtual cards, you eliminate the need for physical checks, reduce the risk of fraud, and avoid transaction fees typically associated with traditional payment methods. Each payment is tightly controlled and easily tracked, providing an additional layer of security for your AP process.

When it comes to choosing an AP automation solution, you should understand the difference between bolt-on and embedded finance solutions. Bolt-on solutions, like those offered by some payment processing companies, require you to integrate multiple systems. This often means manually entering data into your general ledger and then using a separate system to process payments. These solutions can work, but they add complexity and potential for errors.

On the other hand, embedded AP automation, integrates directly into your accounting software (Accounting Seed). With an embedded solution, everything happens within one system—you don’t have to leave the platform to match invoices, create payment proposals, get approvals, or do reconciliations. This seamless integration reduces errors, saves time, and gives you real-time visibility into your finances.

Part 3

The prospect of changing over your existing accounting system can be daunting. We recommend you begin by taking a look at your current processes, understanding the potential impact, and evaluating the best solution for your business needs. Use the following questions as a guide to determine if your organization is ready to take the next step.

Accounts Payable (AP)—working in tandem with Accounts Receivable (AR)—is a crucial function that never stops. There are always bills to pay and tasks to complete daily. If not managed well, AP can become a burden on the business, consuming more and more of your team’s time, increasing the risk of fraud, and failing to provide leadership with the timely insights they need. However, when the AP team is supported by automation, it enables your entire organization to run more efficiently, turning AP into a valuable asset.

As you explore AP automation options, keep in mind how an embedded solution, such as Accounting Seed can integrate payment management directly within accounting software and support the long-term growth of your company.

Our cloud-based solution is built on Salesforce, ensuring your sales and financial data truly live in the same house and eliminating silos of missing or inaccurate information. This means you don't have to leave the platform to pay your bills. You can manage invoices, match them to vendors, create payment proposals, and send them for approval, all within Accounting Seed. If you’re tired of wasting time sorting invoices and paying bills by hand, reach out to book a demo today. We’d love to help.

"*" indicates required fields