In the UK, Making Tax Digital (MTD) is changing accounting requirements businesses face. To remain compliant and even become more competitive, your accounting tool should be able to fully satisfy the demands of the UK market. Let’s delve into accounting software UK users need to maximize the value of their accounting.

Why is Accounting Software Essential for UK Business?

No matter your location or organization’s size, a company is fueled by finances. Accounting technology is vital to smoothly managing the invoices and debits generated throughout your activities and helping you assess business performance. The more flexible and adaptable the software, the more your accounting lifecycle can be streamlined too. This is essential on a local, national, and international level indicative of UK business. The more business you create, the more accounting you’ll generate. You need software that can conform to your needs and business complexities.

UK Users Need A Flexible Accounting Solution

The flexibility of your accounting software is simply mission-critical. This dictates how the product will scale to your growth and unique needs. Every business is unique, so an untailored one-size-fits-all type of accounting software is highly antiquated. True value from your accounting system lies with how it conforms and continually adapts to your individual needs and processes.

System flexibility also contributes to how the solution will scale to your organization. The last thing you want is to invest in technology that must be replaced because you’ve outgrown it – especially after the pains to become MTD compliant!

For accounting software that meets all of your needs, consider how optimized the accounting system is for customization. This lets you modify the technology and accounting processes to continually meet new requirements including MTD, the International Financial Reporting Standards (IFRS), and other regulations. Let’s look at some additional features you need in order to effectively operate in the UK.

Top Features for Accounting Software UK Users Need

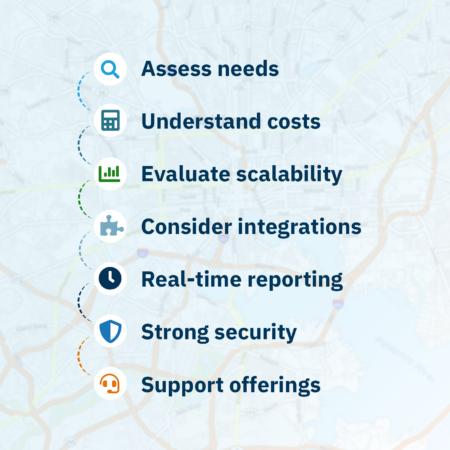

Small-to-medium sized businesses and enterprise organizations need core accounting and technology features to really maximize their financial management. In addition to being flexible, you’ll want to look for these top features to help excel in the UK.

Cloud-based

Cloud-based technology can be used to work and share data anytime and anywhere you are. Besides making processes become faster, this means you and your team are no longer restricted to an office. This is vital during this coronavirus outbreak because your company can remain focused and financially healthy while operating totally remotely to avoid the virus spread! Cloud accounting also gives you real-time data to make the best decisions possible for your business at all times. The Cloud also enables your accounting solution to work with other cloud-based solutions.

Connectivity

The way accounting software works with your other essential apps defines the accuracy and ease of your accounting processes. Nobody wants to spend hours and money manually entering accounting details and then re-checking them. Connecting your accounting tool to relevant business tools is the solution. For the best connectivity to your other tools, make sure the accounting tool has a robust API. For a more streamlined IT system, consider using shared-platform solutions like Salesforce and its native apps.

Bank Direct Connect Functionality

You’ll also want to consider how your accounting software will conduct invoicing and wire your money effectively. Make sure your accounting system is equipped with a bank direct connect feature to reliably process bank and credit card transactions. If you operate internationally or have many accounts, make sure the system can connect and process transactions to the institutions you are using. Accounting Seed’s bank directly connects links to more than 14,500 banks and credit card companies to easily batch import/match transactions. The more versatile bank direct connect, the easier and faster you can get paid and wire funds.

Transaction Scalability

A common misconception is that accounting should be based on revenue size. This isn’t the case. A billion-dollar company may only have a few transactions per year, while a 5-10 million dollar company could have extremely high volumes of transactions. Therefore, the number of transactions directly reflect the scope required for your general ledger and other accounting features. Make sure your accounting software has the general ledger architecture that you need to scale.

Automated Accounting

Everyone wants their accounting to be faster, accurate, and easier; the key to this is automation. The availability and flexibility of your solution’s automation functions are not only a convenience but important for helping you manage increasing transaction amounts. These are the most useful and important types of accounting automation: Event Automation, Batch Automation, and Scheduled Job Automation.

Security

A major area of MTD requirements, your accounting software must be able to protect your financial data, and customers’ data, from both internal and external security threats. Besides including password and encryption features, UK users should also look for internal security features.

Internal security features let you establish internal controls that fully control access to view, alter, approve, and share vital data. Features like Two-Factor Authentication, User Permissions, and Validation Rules are highly important for letting you fully safeguard your accounting. Most accounting applications don’t have in-depth security features like these. Consider using an accounting platform that will allow for more control of the technology.

Choose the Accounting System that Works for You

As your business expands and diversifies, look for UK accounting software that adapts with your changes, instead of being restrictive. For other valuable accounting features and tips on how to select the best accounting software for your business, check out our free Accounting Technology Buyers Guide.

Download Accounting Seed’s Free Accounting Technology Buyers Guide

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.