Guide

Bad financial data is costing you more than you think.

Here's how to get back on track

Guide

Here's how to get back on track

Finance is the engine that powers every business decision. In order to ensure the engine doesn’t break down, you must have a strong foundation. Without it, you are left spinning your wheels—wasting precious time and valuable resources.

Navigating today’s dynamic business landscape demands fast and accurate financials. Companies need a clear path forward to achieve reliable financial insights, which shape their direction and fuel their growth. This puts a new level of pressure on the role of finance and changes the way businesses view and interact with financial data.

Several recent trends have accelerated the seismic shift in the role of finance while creating new challenges. These include the rising cost of labor and talent shortages, advancements in technology led by AI, and the rapid speed at which we do business. The past few years alone have seen a 17% drop in the number of accountants coming into the profession.

If you haven’t made a shift from spreadsheets to strategy and started running your finances with smart technology, consider this a wake-up call.

With these changes happening in a short time, many companies are realizing their approach to finance is out-of-date and struggling to adapt to a new era. The rules of the game are not what they used to be. In our experience, companies grapple with three key issues that stand out from most, all of which are related to the integrity of their data:

Here we’ll take a closer look at each of these three issues, as shared in the latest Piper Sandler Office of the CFO report, and shed light on how your company can fix them.

The irony of your business growing? It can ruin your data hygiene. The story usually goes something like this: As your business expands, it leads to iterative changes to handle the increased scale. You buy new apps, add more third-party tools, and rely on a bunch of independent programs that each require data to work.

We’ve recently seen unprecedented levels of “SaaS-turation” as businesses become exhausted from app overload. You might be surprised to tally up just how many apps it takes to run your business. On average, organizations used a staggering 371 apps in 2023, an increase of 32% since 2021, according to data from Productiv.

Over time, more stakeholders, including leaders, IT administrators, and accountants get involved and have their own data to add to the mix. Complicating matters, your marketing and sales data often becomes disconnected from financial data, even though you need both in the same place to fully understand how your business is doing.

Bad data creates frustration across the board. Your business is now over-budget with frustrated company leaders, stressed out IT administrators, and accountants who lack the timely and accurate data necessary for their work. The traditional approach of adding more apps and more staff while constantly verifying data makes the cycle disastrous.

Companies often resort to costly “quick-fix” solutions that do little more than slap a bandaid on a deeper problem. They hire expensive integration firms, buy middleware, or bring on more IT staff. However, these solutions can be slow and often fail to do the job long term, leading to a constant state of repair and eventually an overwhelming back-office mess.

To combat accounting dysfunction, we’re now seeing a countertrend called the “Great Rebundling.” Many companies intend to consolidate vendors, with 71% citing cost savings as their motivation to do so. On top of that, 80% of CFOs are expressing interest in switching to a single-vendor solution.*

Even if the appetite for consolidation is there, many companies have no idea how to combine their AP and AR, spend management, bill pay, cash flow, forecasting, and other financial functions.

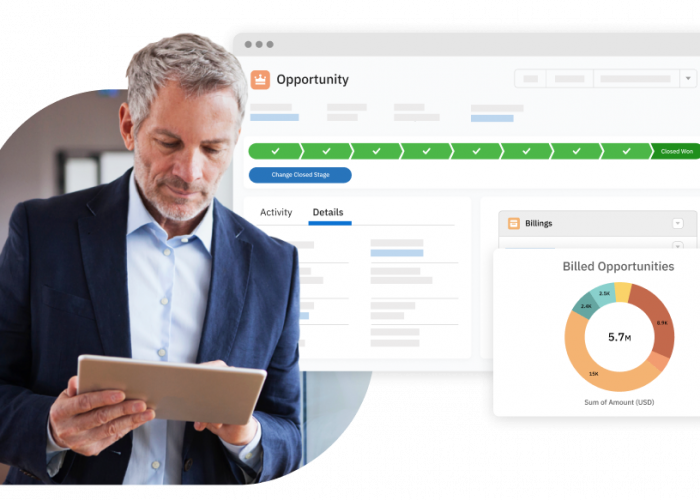

Accounting Seed recognized this problem over a decade ago and developed the solution. Built on Salesforce, Accounting Seed allows you to run your business on a single platform sharing one data source.

Accounting Seed is ideal for businesses running their sales, service, or operations on Salesforce and easily allows you to automate processes across different data layers without coding. This approach vastly differs from other providers who leave you with a pool of disparate apps.

Uh-oh. Month-end is approaching fast, and your company realizes the data you have over here doesn’t match what you have over there. So now finance is skipping lunch to track down data ghosts across multiple systems and 100 different Excel tabs. They’re in agony. You’re stressed. And your business suffers as a result.

Sound familiar?

It used to be that company leaders would look to their finance teams to perform routine, manual tasks—a big one being data entry.

Less than 10 years ago, the majority of finance teams would spend anywhere from a quarter to more than half of their time collecting, entering, and validating data.

But this is a slow way to go about managing your books and introduces the possibility of human error when accuracy is critical.

You can now automate most of these once manual jobs, which over time has steadily freed finance teams to contribute in new ways that help businesses grow and make better decisions.

Industry reports highlight how finance teams today are now more involved in areas like business planning, risk management, and revenue growth. An increase in long-term strategic planning by finance teams from 30% in 2021 to 39% in 2023* reflects this shift.

If finance in your organization is still primarily tied up with data entry and reactive reporting, you need to reevaluate your approach and systems. Think about it this way: If finance could reclaim as much as three-quarters of their time back, how much more value could they add to your company?

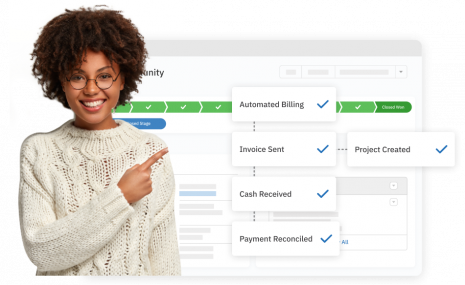

Embedded finance, or integrating payment management directly within accounting software, is a trend now catching fire due to its massive time-saving benefits. Payment integration automates key steps, such as reconciliation—updating transactions directly into bank accounts and general ledgers.

Accounting Seed is designed to help businesses make the transition from manual to automated data entry and management. And through embedded finance solutions such as automated Accounts Receivable, companies can shave hours off of their reconciliation process while saving thousands in fees.

Accounting Seed’s soon-to-be-released AP Automation solution creates more efficiency, allowing you to automatically match payables from emails and manage digital transactions.

Bottom line: In an environment where finance is stretched thin, automating tasks doesn’t take away value—it only enhances what accountants can do with their time.

You likely have a wealth of data across platforms that would give you key information to grow your business—including where to double-down, areas to pull back, what’s driving profitability and where telling trends are emerging. But can you access the data? How long would it take to get it in a usable format?

Enter the third issue we frequently see: poor data visibility. These days, knowing the health of your company can’t take weeks. One prime example is the month-end close. If it’s taking most of the month (or more), you're at a significant disadvantage. The frequent delay of visibility into company performance leads to poor decisions. It means you're acting off of old or incomplete data and taking unnecessary risk, resulting in stagnant growth while your competitor is already two steps ahead.

All of this is directly connected to financial operations (finops)—one of the three areas most likely to be impacted by automation.* Goldman Sachs also predicts finance as one of the top five industries to be transformed by AI.

The record-to-report process, which can be tedious and manually intensive, is ripe for AI adoption. In fact, 55% of finance executives are aiming for a 'touchless financial close' by 2025.*

But here’s the kicker: the promise of AI and automations delivering once-unimaginable planning opportunities can’t work without good, reliable, clean data. You need to nail the basics first. Machine learning models perform only as well as the inputs they receive.

At Accounting Seed, we’re already laying the groundwork to harness AI with our Financial Analytics product. This tool will facilitate generative AI applications in areas like cash flow, customer lifetime value analysis, and forecasting and budgeting. We’re actively working towards achieving that touchless financial close company leaders dream of, enabling businesses to make faster, more informed decisions without compromising data integrity or quality.

As the role of finance significantly expands, leaders often deal with disconnected data, legacy processes, and difficulty in getting access to key information at the right time. This leads to poor business decisions and highly inefficient processes. It’s impossible to be proactive or to embrace new tools like automation and get timely updates about your company’s performance.

Every business wants to make decisions based on reliable insights—rather than take random shots in the dark—and save their teams precious time.

But they don’t know where to start.

*Data cited in this blog is taken from the October 2023 Office of the CFO report by Piper Sandler.

We help connect your data, make it easy to understand, and automate your core payment and financial processes, giving you the foundation to grow—all while increasing efficiency in every area of your business. With Accounting Seed, you can focus on what matters most to you.

Interested in taking the next step? Book a demo with Accounting Seed today. We’d love to see how we can help.

"*" indicates required fields