Guide to AR Automation

Save 52 hours every month with automated AR

What’s driving businesses to automate AR?

3 pressures pushing manual accounting to the breaking point.

Guide to AR Automation

What’s driving businesses to automate AR?

3 pressures pushing manual accounting to the breaking point.

How much did we make last month Where did the revenue come from? How much can we still plan to collect?

If these questions sound familiar, you’re in the right place.

Assess your current processes and discover the steps you need to take to prepare for implementing AP automation to enhance efficiency and decision-making.

Read Part 2Discover the key features of AP automation, from automated payments to enhanced security and real-time financial insights through seamless integration.

Read Part 3

part 1

Businesses rely on their Accounts Receivable (AR) processes to function efficiently, as they play a crucial role in providing visibility into cash flow. The AR team's ability to perform AR-related tasks quickly and accurately is essential for converting sales into cash, managing liquidity, and ensuring financial stability. With ongoing advancements in accounting automation, you might assume everyone has their process for tracking payments down to a science (spoiler alert: they don’t).

Surely, the days when accountants had to manually tick and tie transactions until their necks ached or chase down paper checks are in the past…

When it comes to AR, it's often a case of "we're not where we want to be”—and the impact of delaying automation is felt through the entirety of an organization.

Here we take a look at the top three pressures driving the need for AR automation, and what’s at stake for businesses who don’t make a move.

This one may seem obvious, but it’s the most important area of the business being exposed to unnecessary risk. Without knowing exactly when money will come in, it's hard to manage cash flow or plan for the future. The faster a company collects payments, the more cash it has to pay expenses, support daily operations, and invest in growth. Unpaid bills or late payments can make it difficult to cover costs, even when sales are strong. In those situations, companies may unnecessarily turn to a line of credit or hold extra working capital just to keep operations running.

As a result of these inefficiencies, finance teams are often overworked and CFOs have to hire more staff to keep up. Processes that barely manage to close the books each month often reveal their shortcomings when it comes to cash flow and visibility. The issues permeate up the chain where business leaders want to make confident decisions but can't. They simply aren't receiving the numbers fast enough to act or when they do—they can't trust what's in front of them. As a result, 49% of executives worry about the reliability of their cash flow information and 98% believe they could have better cash flow visibility.

So what's really going on with the day-to-day of AR? Industry research indicates the majority of teams are still spending anywhere from 4 to 13 hours a week on AR tasks. Here are the activities that often eat away at this valuable time:

Despite a finance team's best efforts to manage, track, and reconcile money coming through the door, they're often playing catch-up—especially as a business grows and transaction volume increases. In fact, a survey of CFOs found that 77% of AR teams say they're behind, with 22% admitting they are months behind.

It's clear that companies recognize the value of automation—93% of mid-sized businesses are working toward further AR / AP automation.

Let’s explore why:

Executives in one study reported the benefits of automating include improved productivity of the AR team (67%), increased customer satisfaction (67%), and better customer retention (56%). In addition, 89% of executives who have a mostly automated AR process are seeing customer payment terms on time or early. This is made possible by features like automated emails that prompt a customer to pay and secure payment sites—all of which make it easier for businesses to get paid faster.

There's a clear gap between the desire to automate AR and what's actually put into practice. While businesses recognize the potential of AR automation to improve cash flow, reduce manual work, and provide better financial insights, many are stuck.

The next step for companies is to recognize that the future of AR is already here.

Implementing AR automation software can reduce time spent on cash collection by up to 80%. The technology exists, and the benefits—faster payments, more accurate data, and less manual work—are within reach.

By overcoming the hurdles of cost, training, and resistance to change, businesses can finally align their sales with the cash coming in the door and get paid faster. The question isn't whether you can afford to automate your AR processes—it's whether you can afford not to.

Ready to take the first step towards faster payments and improved cash flow? Explore our AR Automation solution now.

part 2

Make payments easy. Get paid faster. Watch your business grow.

Nearly 60% of U.S. businesses link poor cash flow and forecasting on outdated manual Accounts Receivable (AR) methods.

Here's a common scenario:

Your company celebrates record-breaking sales, but the AR team drowns in manual work. Staff creates billings, sends invoices by paper or email, and processes payments by hand. Partial automation efforts fall short, as teams still struggle to reconcile data across disparate systems—ultimately defeating the purpose.

It “works” for a while, but then cracks start to show: The month-end close drags on. Missed and late payments slow cash flow. Errors creep in—a $1,200 sale might accidentally become $12,000. The C-suite wants to know, “How do we double down and keep this growth going?” but can't get an accurate view of profit direction.

As this example shows: Inefficient AR processes aren’t just taxing on your finance team; they directly hurt your ability to scale.

While 61% of businesses cite upfront costs and implementation challenges as barriers to AR automation—the true downside comes from waiting to make a change.

Let's explore three key reasons to invest in AR automation now and why it's crucial for the future of your business.

Nobody likes paying their bills. Customers often put it off or just forget. This causes big headaches for businesses—43% report too many late or delinquent payments, and 55% of U.S. B2B invoiced sales are overdue. Nearly half of companies find it difficult to reduce Days Sales Outstanding—impacting cash flow management, forecasting, and overall growth potential.

AR automation makes paying easier, so customers pay quicker. With good AR systems, you can not only mass send emails but more importantly give customers a secure, branded website to pay on with configurable payment options.

Think about it: If you get a bill that says "mail a check" or "call us 9-5," are you paying right away? Probably not. It goes in the "I'll do it later" pile. But if you get an email with a bill summary and payment link, you might grab your credit card and pay on the spot.

Now imagine hundreds or thousands of invoices getting paid faster each month. That's a lot more money flowing into your business instead of being stuck in unpaid bills. With more cash coming in, you're less likely to need something like a line of credit just to keep the lights on.

In fact, among businesses that have implemented AR automation, 89% are seeing more customers either meet payment terms exactly or pay early and 53% report better cash flow.

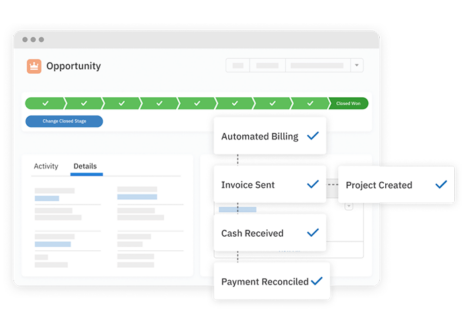

From sale to bank clearance, AR is full of steps that eat up time and invite mistakes. Let's take a closer look at each phase of the process and how automation can solve for inefficiencies:

| AR Step | Manual Process | Errors/Inefficiencies | Automation Solution |

|---|---|---|---|

| Invoice Creation | Staff manually creates invoices, adding details like amount and terms. | Mistyping invoice amount, due dates, or PO numbers. | System auto-generates invoices after a sale. |

| Invoice Delivery | Staff mails or emails invoices individually. | Time-consuming; delays between when an invoice is created and sent to the customer. | Auto-generated invoices are sent in bulk via email. |

| Payment Received | Customer mails in a check or calls in payment. | Missed or late payments. | Customers pay via an online branded payment site linked from email. |

| Payment Processing | Accountant manually records and matches payments to invoices. | Human error in the matching process. | Payments auto-match with invoices. |

| Bank Reconciliation | Accountant manually matches bank deposits with system records. | Errors in manually matching transactions, leading to discrepancies. | Bank transactions are auto-imported and matched to payments. |

| Final Clearing & Reporting | Accountant manually reconciles and ensures payments are recorded before closing the books. | Missed or delayed reconciliations. | Payments auto-clear, and real-time reports are generated. |

Even for those who have implemented some level of automation, AR is still a challenge for many companies to manage: 41% of finance teams still spend time fixing manual errors, 36% still rely on spreadsheets and CSV files to transfer data manually, and 30% manually code transactions to the general ledger.

By implementing AR automation, businesses can reduce time spent on cash collection by 80%. In addition, 67% of businesses that have automated their AR see improved productivity of the AR team.

Manual AR processes and data entry errors muddy up real-time financial reporting, making it challenging for businesses to track cash flow accurately. Automation helps solve this, but many companies still struggle with a common issue: Their sales data lives in a CRM, separate from their financial data. This setup requires you to connect sales and finance data through third-party integrations that pull data from various sources, but these integrations are not always in sync (and rarely in real time).

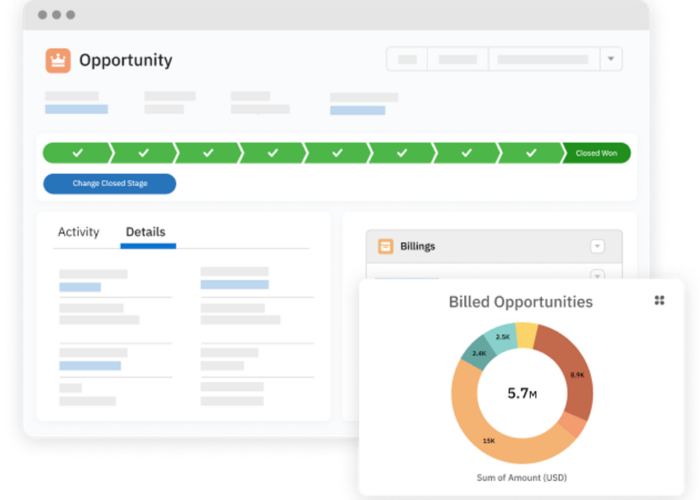

The real advantage comes with embedded AR automation—or solutions built directly into your sales platform. For instance, with an embedded system, you can have a sales record automatically generate a corresponding invoice. This beats bolt-on solutions that rely on third-party connectors to run the same task, which can cause delays or be unreliable.

Solutions like Accounting Seed's AR Automation, for example, allow you to manage the entire process from bill receipt to reconciliation within one platform. This setup gives businesses a quick view of profitability trends, enables real-time financial reporting, and helps pinpoint where to focus resources for growth.

Quick payments and clear cash flow insights are vital for business growth. Knowing your money sources and profit centers helps you make informed decisions. But manual AR processes are like speed bumps at every turn. They slow down everything—from sending out invoices to getting paid. Plus, errors can creep in, making your numbers unreliable.

This is where AR automation shines, especially when it's built right into your sales platform. Having everything in one place, rather than scattered across different systems, sets the stage for real-time reporting:

By automating your AR, you're not just saving time—you're setting up your business for faster, smarter growth.

Want to see how AR automation can change your business for the better? Take the next step and book a demo of our AR Automation solution now.

part 3

Are you ready to automate your AR processes? Use our checklist to find out!

For many companies that still mail out invoices, collect paper checks, or manage partially automated AR processes, implementing a new accounting solution may seem like a daunting prospect. That’s why it’s often a decision that gets pushed to tomorrow…which turns into next month, then next year.

In fact, 96% of mid-sized businesses face barriers to adopting AR automation: among them, 38% are concerned about upfront costs, 23% worry about implementation challenges, and another 23% express data security concerns.

The key to success lies in a thoughtful selection process. When you take the time to assess your current system, quantify the impact of automation, and evaluate the features and capabilities you need, you can gather momentum and gain buy-in across departments. The clear upside will be too compelling not to resonate.

Let's take a closer look at how to find the right AR automation solution for your business.

Start with a clear understanding of how your current AR processes work today. A thorough assessment can help:

Did you know? Over 50% of businesses spend between 4-13 hours per week on AR tasks. Quantifying how much time your team is spending can help to crystallize your decision to implement automation or automate more steps in the process.

After assessing your current AR processes, the next step is to evaluate the potential impact of implementing software with automation features. This evaluation helps quantify the benefits and builds a compelling case for change.

Estimate the reduction in hours spent on tasks like data entry/duplicate data entry, invoice matching, and payment reconciliation.

How much could cash flow be accelerated by making the payment process easier for customers? Calculate the potential reduction in days sales outstanding (DSO).

Estimate the reduction in time spent on error correction and dispute resolution.

Estimate the amount of cash that could move from "on the books" to accessible funds.

Consider the value of real-time insights into cash flow, customer payment behaviors, and profitability trends.

Consider the potential increase in customer lifetime value and positive referrals.

Calculate the potential reduction in transaction fees through more efficient payment methods.

Estimate the potential savings from avoiding security incidents and ensuring compliance.

When choosing AR automation software, it's important to compare features and make sure the tool works well with your current systems, like your CRM. As you look at different options, check how well they handle tasks like payment collection, processing, and reconciliation. In addition—and this is a point that is often overlooked—consider whether the solution offers a truly unified platform for your financial data. Closely evaluate the long-term viability of options that connect your front and back office with third-party integrations, which can be unreliable and result in syncing delays particularly as your business grows.

What stages of the AR process can this solution automate? Look for coverage of:

• Payment collection

• Payment processing

• Reconciliation and bank matching

What stages of the AR process can this solution automate? Look for coverage of:

• Payment collection

• Payment processing

• Reconciliation and bank matching

Real customers: “Because we were able to automate our billing process and the payment processing we were able to significantly shorten our time to cash.” - Ellen Fortas, CFO, LB Technology

You can more effectively identify the right solution to automate your AR with a thorough assessment of your current processes, evaluation of the true business impact, and careful consideration of available options.

Keep in mind: Many solutions claim to provide seamless integration for sales and financial data—but unless the data is on a single platform, it’s being “glued” together by integrations and syncing. Having all data reside on a single platform lays the foundation for a single source of truth, which is essential for reliable reporting and real-time financial insights. A unified platform eliminates the need for complex integrations and grows with you as your business inevitably changes.

Whether you're a C-Suite executive or a finance leader recognizing the need for automation, the right solution can save time and money, speed up cash flow, and provide the visibility needed for strategic decision-making.

Ready to take the next step toward automating your AR? Consider how Accounting Seed on Salesforce can provide accurate, real-time financial insight to help your business grow. Reach out if you’d like to book a demo!

See firsthand how our solution can streamline your AR processes and give you faster access to accurate and actionable financial data. Book a demo with us today!

"*" indicates required fields