The #1 Playbook for Accounting Efficiency

Get this step-by-step guide to determine how to implement accounting automation when the growth of your business depends on it

Get this step-by-step guide to determine how to implement accounting automation when the growth of your business depends on it

For many business leaders, that confidence is a pipe dream they’ve never been able to achieve. Now, at the end of another chaotic month-end close, you lack the insights you need to make critical decisions. By the time you gather and analyze the necessary data, it’s already outdated. With your team drowning in spreadsheets and manual processing, you face the risk of turnover and struggle to gain the real-time visibility needed for decisive action. Will you have to hire more staff just to keep up?

Certainly the rise of automated accounting is not lost on you, but you also don’t know where to begin (nor do you have the time to look).

Maybe you’ll get to it next week.

You're swamped with urgent matters: a customer issue, a new product line, and a packed calendar. If you're like most business leaders, founders and CXOs, time is your most valuable currency; you're already working nearly 10 hours a day and booked for an average of 37 meetings per week.

That plan to clean up your financial data or look into a new accounting technology? It will have to wait.

While research shows 62% of executives believe accurate, real-time financial data is a "must-have" for the survival of their business, we see business leaders struggling to make it a priority. They feel that it’s not always feasible to pause the daily go-go-go (and risk downtime while in growth mode) to search for a new accounting system.

"We're too busy to stop and implement a new system right now. There's simply too much on our plate."

"What if the implementation disrupts our operations and causes us to miss our growth targets? Is our existing system really that bad?"

"In this uncertain market climate, can we justify the investment in new systems?"

Manual accounting processes consume more of your business's time and resources than you probably realize.

A recent study revealed that 72% of finance teams spend up to 520 hours per year on AP-related tasks alone that could be automated. That's equivalent to 13 full work weeks lost to manual data entry, invoice processing, and payment reconciliation.

Blind spots in your books

Cash flow is the lifeblood of your organization: you need cash in the bank to keep the lights on, pay your bills on time, and make strategic decisions. PwC's survey of CEOs emphasizes how the absence of accurate, real-time financial data impairs decision-making, reduces agility, increases risk and hinders long-term planning. Yet, a lack of reliable and visible cash flow data continues to be a rising concern among CEOs, financial leaders, and executives. One survey found 49% of executives worry about the reliability of their cash flow information and 98% believe they could have better cash flow visibility. Manual accounting processes, such as those that require your team to stitch together data from different places in order to glean insights, make this difficult (if not impossible) to achieve.

PwC's CEO Survey shows that 36% of a CEO's time is spent in reactive mode. In today's competitive environment, business leaders need to spend more time on offense—strategizing about future opportunities and navigating market challenges. However, when your finance team is bogged down with manual tasks like entering bills, sorting invoices, and mailing checks, they can't contribute meaningfully to your company's future direction.

As a result, you will perpetually lack the real-time, accurate financials you need to guide the business forward.

When you lead a business, growth is top of mind. What new markets should we enter? What product should we launch next? Who should we acquire? A recent Gartner survey reveals that 62% of CEOs selected growth as their top business priority for 2024, the highest level since 2014. Yet, according to BlackLine, 37% of CFOs admitted they do not completely trust their own financial data. That number is higher among 50% of senior finance and accounting professionals, who indicate they don't fully trust the numbers they're working with (even though they are closer to them!).

As a result, you're essentially navigating your growth strategy blindfolded. How can you make informed decisions about expansion, investments, or new product launches when you can't trust what the underlying financial information is telling you?

56% of finance teams are still reconciling bank statements manually.

Automating Accounts Receivable (AR) processes improves your cash flow, team productivity, and customer relationships. With AR automation, you can expect to see:

Automating more of your accounting processes—which often requires pulling the trigger on a new accounting system—can be daunting. Here are some questions to explore to help you determine if you’re ready (or more likely, overdue) to make a change:

Are manual processes consuming too much of your finance team's time every week?

Are you hiring more accountants without seeing increased strategic output?

Do you struggle with real-time visibility into your cash flow?

Is your current system unable to scale with your business growth?

Do you struggle maintaining audit trails and dread “audit season”?

Are you experiencing frequent errors in data entry or financial reports?

Do you need better integration between your accounting and CRM systems?

Are you looking to improve your financial decision-making with more timely and accurate data?

Do you need more robust security and fraud prevention measures?

Are you seeking ways to improve customer and vendor relationships through better financial management?

Do you require multi-currency or multi-entity capabilities?

Are you interested in automating tasks like revenue recognition, recurring billing, or bank reconciliations?

As you search for the right fit, consider Accounting Seed to be your trusted resource in helping you. Our cloud-based solution is built on to Salesforce, ensuring your sales data and financial data truly live in the same house and eliminating silos of missing or inaccurate information. Accounting Seed offers complete automation of your AP and AR processes, while providing real-time financial reporting and analysis capabilities, all within the familiar Salesforce ecosystem.

In the words of Marina Peterson, CFO at Downtown Streets Team and current Accounting Seed user:

“What used to take two days using Excel takes two hours in Accounting Seed for bank reconciliations. Now my team can focus on staying on top of our expenses—ensuring that we are spending our contracts correctly, that we are spending in the right budget lines and are able to make budget revisions. It’s made them partners.”

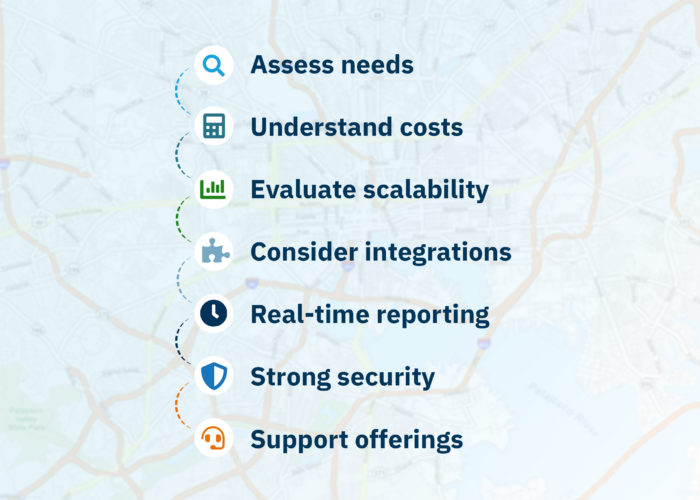

We understand there are several accounting solutions available, and making a change requires commitment and a clear vision of your business processes. Using this playbook as a guide can help you understand the key foundational aspects you should consider when making a selection.

Our team partners with you to overcome those initial hurdles and help you achieve greater efficiency and financial data you can rely on. Reach out today to book a demo—or for help with any of your accounting needs!

At Accounting Seed, we have expertise in helping companies automate their AR and AP processes and will assist you every step of the way! Book a demo today.

"*" indicates required fields