Columbia, Md., [November 9, 2021] – Accounting Seed, a top-rated accounting solution powered by Salesforce, unveils a new consolidations feature in the Magnolia Release, phase one of a three-part release. This upgrade also brings significant updates to the platform’s Bank Direct Connect, bank reconciliation, and permission set features.

“Our customers have been looking forward to native consolidations, and we are so pleased to bring this Lightning-ready feature to our users,” said Chief Technology Officer, Ryan Sieve. “Particularly for companies that operate with multiple entities in the United States, Magnolia brings even more ease of use and shows that we are a solution that grows and scales with their needs.”

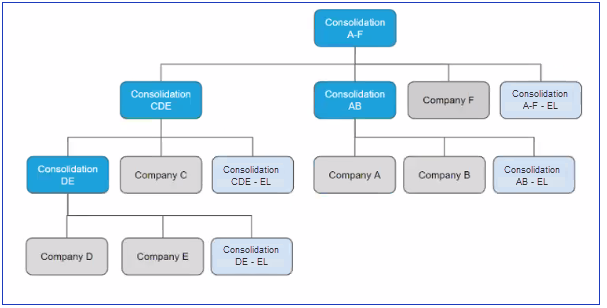

Consolidations allow users to combine assets, liabilities and financial data from two or more legal entities into one. Phase one of the Magnolia Release sets Accounting Seed users up for successful financial consolidations by enabling smooth setup of ledger hierarchies, easy access to financial reports and dashboards, and auto-creation of elimination ledgers.

The majority of Accounting Seed customers are growing businesses that require consolidations. Through Accounting Seed’s consolidations feature, businesses will now be able to:

- Be fully compliant with accounting standards related to consolidations.

- Accurately forecast company goals.

- Convince stakeholders to make strategic investments.

- And much more!

The Magnolia Release brings other vital features and updates, including:

- Matching source record updates to Bank Direct Connect.

- Bank reconciliation performance updates.

- Cash In permission sets update on bank deposits.

For more information on this new technology and the release schedule, watch the Magnolia Release overview and review the release notes.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.