If you work in the lending or microfinance industry you know all the nuances that go into managing loans. Wouldn’t it be nice if there were a program that allowed you to take the data from your CRM and automatically push it directly into all the stages of the loan cycle and back office? Now there is. Cloud Lending and Accounting Seed have come together to create a solution that combines your CRM with your Accounting and Loan Management programs.

Cloud Lending helps manage your loan throughout the entire loan cycle: from underwriting to origination to collections. Accounting Seed provides an integrated General Ledger and the Accounts Payable.

“The partnership with Cloud Lending and Accounting Seed in conjunction to being native on the Force.com platform, this is a powerful, collaborative, and holistic solution for the lending and accounting market.”

— Saji Johnson, Chief Strategy Officer, Cloud Lending

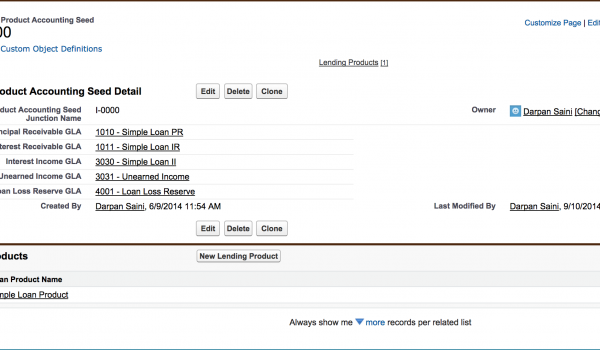

The way that the integration is designed is by using Cloud Lending’s loan management tool as a sub ledger to the Accounting Seed General Ledger. Since the integration is fully automated on a single platform the sub ledger will auto populate into the General Ledger. This integration is advanced and can handle complexities such as:

- Splitting of loan payment between the principle and interest amounts

- Recording loan origination

- Recording loan funding

- Loan balance tracking

- Interest paid to date on a loan

- Interest paid in any accounting year or periods on a loan

Cloud Lending and Accounting Seed provide the ultimate solution for any company that specializes in lending. Together these fully native Salesforce applications will elevate your business to the next level.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.