As your business develops, your financial management needs to be aligned to scale. In short, this is the only way to ensure you have the financial resources in place to progress. Let’s take a deeper look at how and why you should scale your accounting.

Why Does Your Accounting Need to Scale?

Businesses search for accounting systems when their current system can’t keep up with business as it grows. As a result, most buyers look for an immediate fix. They ask, what is the accounting tool that will give me the functionality that I need right this moment? Consequently, when you buy a solution for your current needs, it will become outdated soon. One of the main reasons you need your accounting and accounting system to scale is so that you can avoid upgrade costs and time lost managing growing finances.

Your organization will keep growing and changing. The complexity of your organization won’t stop with the accounting solution you purchase. It’ll only ramp up. Therefore, you need a solution that has the flexibility to scale and customize to suit changing requirements. When you begin your search for new solutions, don’t just think about your current pain points. Think about how new pain points and issues will come about and how you’ll deal with them. First, consider the likelihood of growth and expansion. Your search for a new accounting app truly ends when you have a solution that’s adaptable and scalable enough to solve your problems now and in the future.

How Do Sales Transactions Dictate Scalability?

Accounting is very different between small-to-medium and enterprise businesses. In fact, complexity in accounting is typically driven by transaction volume. The rate of things like sales invoices and cash receipts reflect the generation of debits and credits that the company’s accounting system must account for.

A common misconception is that accounting should be based on revenue size, but this is not the case. A billion-dollar company may only have a few transactions per year. However, a five-million-dollar company could have extremely high volumes of transactions if it’s selling low dollar items. In conclusion, the number of transactions is more decisive than the value of revenue.

Scalability and General Ledger Specifics

Your number of transactions reflects the scope of detail required for your general ledger and other central accounting features. To scale effectively, you must think about what the transaction volume looks like in your organization. Additionally, think about whether your volume increases going forward. To sum up, scaling your accounting involves examining how your general ledger is equipped to manage these transactions.

General Ledger: Foundation of the Accounting System

Above all, the core of any accounting system is the general ledger. The general ledger is a comprehensive record of all accounting activities for a legal entity where all detailed transactions or recorded summaries are housed. All your transactions generated from your various financial interactions or via banks ultimately flows into the general ledger. Here’s what makes the general ledger the core of accounting and a central consideration for how you scale.

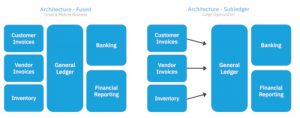

The accounting system’s general ledger structure and capacity are defined by two primary architecture formats: fused and subledger. Here’s a quick breakdown of the two:

Fused general ledger

Fused ledgers use a one-to-one correlation between source transactions and accounting entries. Every time a source transaction is done, the general ledger is updated with the individual transaction(s). This is optimal for small-to-midsize businesses that aren’t generating tons of transactions.

Subledger

Subledgers utilize a many-to-one correlation between source transactions and entries. The subledger serves as a self-contained accounting unit. It contains transaction details needed for a summarized journal entry recording the net accounting change in a general ledger. This can be recorded for a specified time period such as a day, week, or month. This lets companies with a high rate of transactions manage bulk transactions more easily and faster.

An Accounting Platform Provides Unlimited Scalability

Many companies face the dilemma of which type of general ledger is best for them. Or, they have to change to another system when they outgrow the ledger. Settling on just one or the other system leaves the business somewhat limited in options. This is particularly true if the small-medium business is growing in transaction volume. If a company starts off with a fused system and its amount of transactions rapidly increases, they would need to switch to a completely different accounting solution that uses a sub-ledger.

The Accounting Seed platform is unique in that it allows you to access both types of general ledger architecture systems. In fact, you can run both at the same time and pick the right architecture for your company on a module basis. Accounting Seed’s flexibility accommodates all business sizes and types. You never outgrow your system, while constantly being able to readjust your accounting upon need.

A native Salesforce accounting app, Accounting Seed, provides a full 360-degree view of your business’ performance to help you and your accounting team make the best decisions possible. Not on Salesforce? Our software can be customized to work with any system you have through a reliable connection.

See Accounting Seed in action

Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM.